Want to Do a 1031 Exchange in Texas? Maximize Your Investment Potential with Expert 1031 Exchange Guidance

Navigating the complexities of 1031 exchanges can unlock unparalleled advantages for real estate investors, leading to significant tax benefits and the potential for enhanced portfolio growth. At Blue Collar Commercial Group, we specialize in guiding clients through the intricate 1031 exchange process, ensuring a seamless transition while maximizing investment outcomes

What Are 1031 Exchanges?

A 1031 exchange, named after Section 1031 of the U.S. Internal Revenue Code, is a powerful tool for real estate investors seeking to defer taxes on the exchange of certain types of property. Unlike a typical sale, a 1031 exchange allows investors to sell a property, reinvest the proceeds into a new property, and defer all capital gain taxes. This strategic move not only preserves capital but can significantly augment an investor’s ability to invest in higher value properties, enhance portfolio growth, and achieve long-term financial goals.

Key aspects of 1031 exchanges include:

Key Benefits of 1031 Exchanges

Navigate the intricacies of deferring taxes and maximizing investment opportunities

Step 1: Decide to Sell and Plan for an Exchange

The journey begins the moment you decide to sell an investment property with the intention of reinvesting the proceeds into another like-kind property. It’s crucial at this stage to consult with a tax advisor or a 1031 exchange specialist to ensure that your property qualifies and to understand the implications for your investment strategy.

Step 2: List and Sell Your Property

After deciding to proceed, list your property on the market. Upon securing a buyer and making the sale, the 1031 exchange timeline officially commences. It’s imperative to work with real estate professionals familiar with the nuances of 1031 exchanges to ensure smooth sailing.

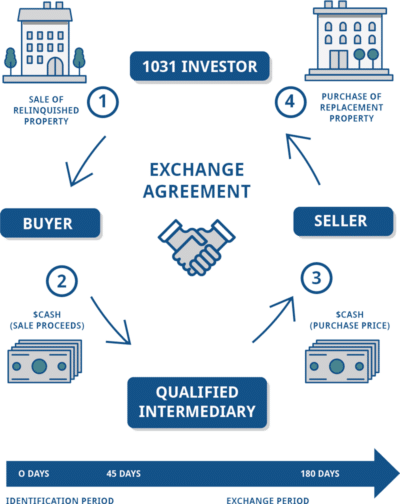

Step 3: Engage a Qualified Intermediary (QI)

Critical to the process is the selection of a Qualified Intermediary. The QI acts as the middleman, holding the proceeds from the sale of your relinquished property. This step is vital as direct receipt of the sale proceeds by you, the investor, can disqualify the exchange due to “constructive receipt” concerns.

Step 4: Identify Replacement Property

Post-sale, a 45-day identification window opens, within which you must formally identify potential replacement properties. This identification needs to be in writing, clearly describing the properties under consideration. There are specific rules regarding how many properties you can identify and under what conditions, such as the “Three Property Rule,” which highlights the importance of strategic selection.

Step 5: Complete the Purchase of Replacement Property

Following the identification, you have up to 180 days from the sale of the relinquished property to close on one or more of the identified replacement properties. The QI facilitates the use of the exchange funds for the purchase. This deadline is strict; thus, ensuring the chosen property is vetted and the deal is ready to go is paramount.

Step 6: Report the Exchange to the IRS

The final step involves reporting the completed 1031 exchange on your federal tax return for the year in which the exchange occurred. This is typically done using IRS Form 8824, detailing the properties exchanged, the dates of the transactions, and the financial aspects of the exchange.

Notes on Flexibility and Restrictions

It’s worth noting that while most exchanges are forward, reverse exchanges — where you purchase the replacement property before selling the relinquished one—are also possible, albeit more complex. Additionally, the “200% Rule” allows for the identification of more than three properties as potential replacements, provided the total value does not exceed 200% of the value of the relinquished properties.

Through meticulous planning and adherence to these steps, investors can leverage 1031 exchanges to not only defer capital gains taxes but also strategically re-align their investment portfolios. However, the complexity of 1031 exchanges highlights the necessity of partnering with professionals specializing in these transactions to ensure compliance and maximize the benefits.

Download Our Free 1031 Exchange eBook

Dive into the realm of real estate investment with our enlightening free 70 page eBook, “Understanding 1031 Exchanges in Texas: A Comprehensive Guide for Commercial Real Estate Investors”. With a blend of basic definitions, advanced strategies, and future outlooks, this guide empowers you to navigate the nuanced world of 1031 exchanges in Texas confidently. Download your free copy today and unlock the secrets to maximizing benefits through 1031 exchanges in the vibrant Texas real estate market.

Why Choose the Blue Collar Commercial Group for Your 1031 Exchange?

Your San Antonio & Hill Country 1031 Commercial Real Estate Agents

Embarking on a 1031 exchange is a decision that can redefine your investment trajectory. Here’s why partnering with us will make all the difference:

SIGN UP FOR FREE E-NEWSLETTER

STAY CURRENT WITH LATEST DATA

12 Tips for Strategic Commercial

Real Estate Transactions

Twelve amazing tips that will help you value your property, lease vacant space, and find the perfect location for your business.

Establish a pricing strategy

Understand investors’ points of interest

Know your market

Attracting tenants

Lease vs. Buy

Much more!